Is buy-to-let worth in the UK in 2024?

UK buy-to-let investors are keeping an eye on the real estate market in anticipation of future opportunities in 2024.

After a slight dip in home prices in 2023, things are looking up for investors who are thinking about investing in the BTL and more precisely in the buy-to-let fractional ownership sector. Reputable real estate expert Savills projects that UK home prices may grow by 1% in 2024, indicating that property values will likely rise once more.

It’s critical to assess the value of buy-to-let investments in the UK as 2024 draws closer. This analysis will include data from leading industry players like JLL, with a specific focus on the prospects of buy-to-let homes.

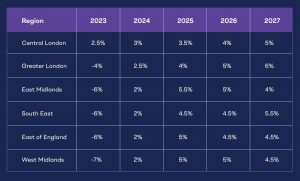

Their projections provide important information for buy-to-let investors by highlighting six important areas that are anticipated to experience strong development.

Let’s examine the buy-to-let element of the property market estimates for 2024.

Making informed decisions about your buy-to-let investments in the UK will be easier if you comprehend the prospective returns and regional variations.

Is Buy-to-Let worth in the UK in 2024?

What the real estate market will look like in 2024 is one of the main concerns of prospective buy-to-let investors. The consensus among experts seems to be that rents will continue to rise.

Rents will rise faster than salary growth, according to Zoopla, as demand for rental properties rises.

Rental growth is predicted to reach 9%, while wage growth lags at 6%, as many would-be buyers are forced to stay in the rental market due to unaffordable mortgage rates.

Prominent real estate advice firm JLL concurs with this prediction. According to their most recent prediction, rental costs would rise at an average annual rate of 4.2% over the following five years, surpassing salary growth in 2024.

Regional Variations and Investment Potential

The rental market in the United Kingdom is not homogeneous, and geographical variations significantly influence the investment environment.

It’s expected that Bristol, Birmingham, and Manchester will be England’s top performers. Up to 2027, these cities should see average annual growth in rental prices of 3.4% to 4%, which will be far higher than the 3% national average.

In Scotland, Edinburgh and Glasgow are also drawing attention for 2024. These Scottish cities are expected to have the greatest rental growth rates in the UK, growing at an astounding 5% annually, along with Manchester. This price increase is anticipated to be driven by the North’s growing demand.

It is anticipated that London will continue to have a distinct position in the rental market. It is anticipated that rental growth in Greater and Central London will exceed the national average and continue well beyond 2027.

The Affordability and Entry Points

For prospective buy-to-let investors, affordability is a crucial factor in these rental market dynamics. The Midlands presents itself as a desirable area for investors because of its affordability. The Midlands are positioned as a possible entry point for real estate investment in 2024.

However, despite the possibility of more rental revenue, London and the South continue to be among the most expensive areas of the country. Nonetheless, following difficulties since 2016, it is anticipated that London and the South East will recover in the upcoming years.

The interaction of rental growth, regional differences, and affordability factors will determine the value of buy-to-let investments in the UK. It’s critical to closely monitor these property market estimates and evaluate how they correspond with your investment objectives in order to make well-informed investment choices.

Is Buy-to-Let Worth in 2024: Navigating Mortgage Forecasts

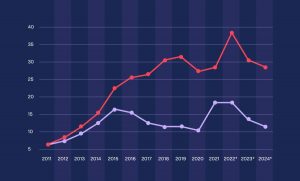

In the United Kingdom (UK), buy-to-let (BTL) mortgage lending for property remortgaging exceeded that for house acquisitions in 2021. It was estimated that this pattern would continue until 2024, when loans for BTL purchase and remortgaging would drop to £11 billion and £28 billion, respectively.

The following graph shows how buy-to-let mortgage lending has changed between 2011 and 2021, along with a projection for 2024. It draws attention to the changing patterns in the UK real estate market and the changing characteristics of buy-to-let mortgages.

Accessibility and Availability

The availability and accessibility of mortgages significantly influence the investment environment in the buy-to-let market. The previous year brought with it distinct economic difficulties that reverberated across the mortgage industry.

Mortgage rates are always changing because of a number of factors, including unstable economies, rising inflation, changes in the Bank of England base rate, and shifting funding costs for lenders.

The result of this volatility is that mortgage products are constantly being introduced into and removed from the market.

This implies that investors need to have a strong risk mitigation plan and an operational attitude. These factors are essential for protecting long-term investment strategies, especially in the buy-to-let market.

Investing in buy-to-let properties requires the same amount of attention to detail and thoroughness as overseeing a pension fund.

It is imperative for investors to maintain a state of alertness and readiness to modify their approaches in reaction to changing market dynamics and mortgage availability.

The Effect of Interest Rates

It is impossible to overestimate the importance of interest rates as a pivotal factor in the mortgage market. Although the official Bank Rate is actively managed by the Monetary Policy Committee (MPC) of the Bank of England, it is crucial to comprehend how these rates impact buy-to-let assets.

Interest rates have been high in the past few years. The MPC has used this instrument to address the high rate of inflation in the UK. Inflation has been controlled by lowering the money supply and raising the cost of borrowing.

The idea behind this is that by limiting the amount of money accessible, customers will become more frugal and competitive, which will drive down inflation.

Thankfully for investors, inflation is starting to decline, which has sparked debate over whether interest rates have peaked.

Even though the official bank rate is currently somewhat high, it is anticipated that rates will either go down or stay the same beyond 2024. Lower mortgage rates are actually the result of lenders’ competitive fixed-rate mortgage offerings.

For investors, the announcement of decreasing mortgage rates is good news because it makes buy-to-let properties more appealing and affordable.

Lender confidence has grown even if the trajectory of interest rates is still unpredictable because of the possibility of lower or stabilised rates.

This means that investors will benefit from better mortgage terms as well as more chances to find affordable finance for their buy-to-let properties.

Loan-to-Value Ratios

Loan-to-value (LTV) ratios are essential in the buy-to-let real estate market because they indicate how much an investor can borrow in relation to the property’s value.

It’s a figure that can have a big influence on an investor’s capacity to enter the market and grow their holdings.

With the changes in the economy over the past year, buy-to-let investors now have different borrowing options. These days, lenders are more stringent, requiring a larger down payment or deposit in order to get favourable terms.

Re-mortgaging has made the borrowing requirement to obtain an LTV of 75% essential because it affects how much an investor can borrow.

Investors should expect difficulties with LTV ratios in the upcoming year, especially when it comes to remortgaging.

There may be difficulties when switching from a low-rate mortgage programme to a new high-rate product because of the LTV ratio.

To Summarise

The buy-to-let market in the UK presents options that are worthwhile in 2024. Savills predicts a 1% increase in home prices, indicating that the real estate market is projected to recover.

The rental sector is attractive to investors since rental growth is outpacing wage growth.

Regional variations present a variety of opportunities, such as the Midlands’ affordability and Manchester’s rapid increase in rental income.

Financing alternatives are improved by favourable mortgage forecasts, which include reduced interest rates and competitive fixed-rate programmes.

In the dynamic world of UK buy-to-let investments in 2024, a strategic and flexible approach can lead to success, even in the face of potential difficulties with loan-to-value ratios.